Ideas, Formulas And Shortcuts For Investment Calculator

If extra investors wish to purchase shares, they're issued the same by the mutual fund funding firm.Closed Ended: Closed ended investments only take out a particular variety of shares that too through an initial public offering (IPO).

One should start investing in SIP because other than inculcating an everyday behavior of investing, it helps accrue extra wealth in the long term with little periodic investments.

Is SIP Safer than Lumpsum Investment? Which means if one is sure that there won’t be any main correction available in the market just after your funding date then lumpsum investment (one-time funding) is preferable.

The last thing you want is to be in a state of affairs where you're absolutely reliant on Social Security funds once you retire as a result of these most definitely won’t cowl your month-to-month bills.

Alternatively, it also enables you to calculate how large the quantity of your periodic investment should be in an effort to achieve your monetary purpose resembling a corpus for retirement or an emergency fund for unexpected medical bills in due time.

Additionally, you may benefit from the recommendations of our in-home funding advisors who allow you to make investments that provide you with greatest returns as per your funding time horizon and threat appetite.

A SIP enables buyers to earn returns not only on their principal funding however on earned returns as nicely, thus, offering the facility of compounding. Power of Compounding: Systematic Investment Plans provide investors with the advantage of the facility of compounding.

70% of ARV Rule: 70% of after restore worth (ARV) is an important rule-of-thumb for investors to recollect, as it helps create a guideline for coming up with a most bid price on a rehab property. The terms of the loan for the funding property are also vital.

Less Risk: SIPs are usually linked to equities and though SIPs carry value threat of damaging returns, it is lower in terms of different investments. ROI is often expressed by way of proportion. The Return on Investment (ROI) is the ratio of the distinction between earnings.

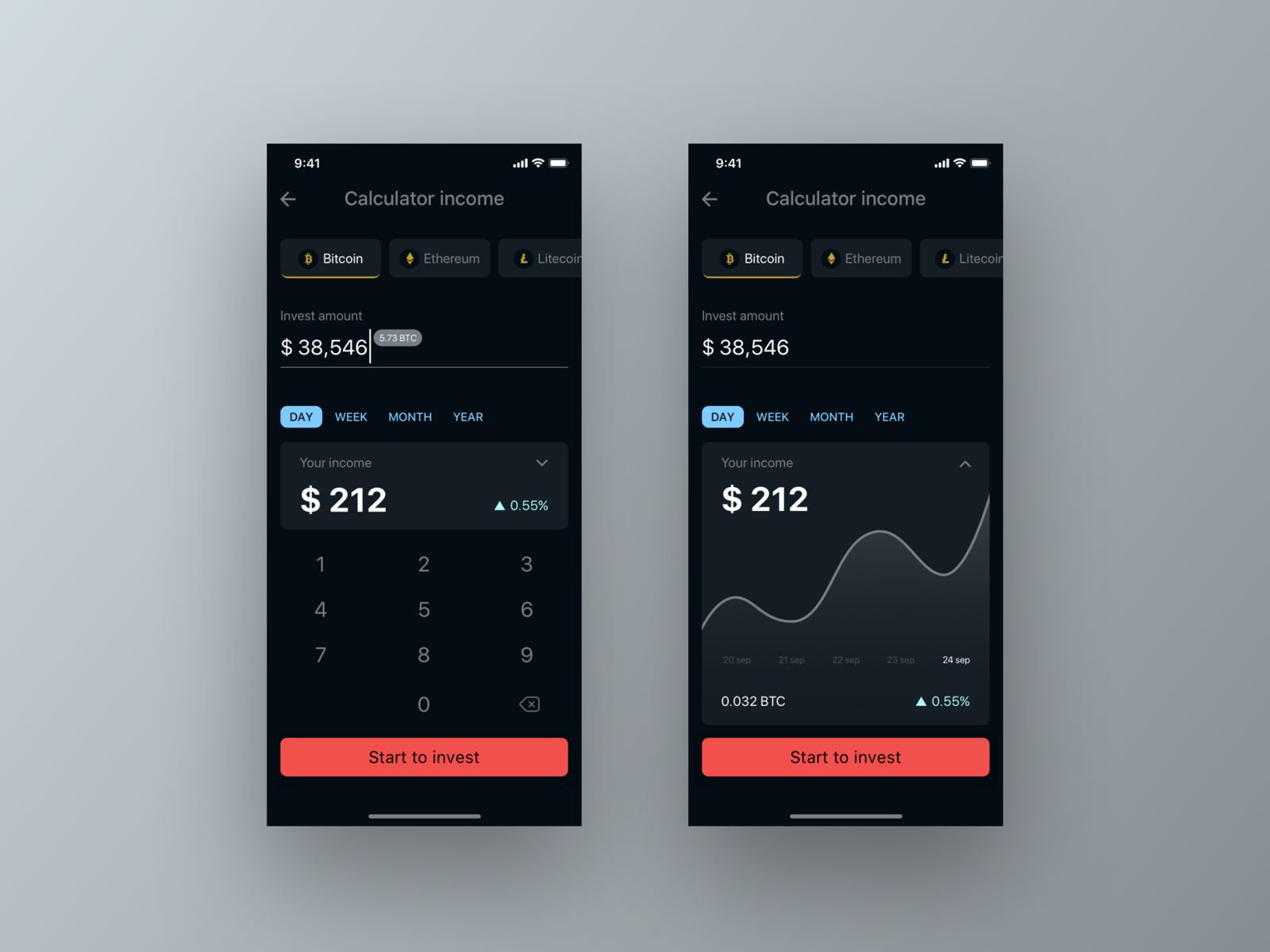

A SIP Calculator is a software which helps you calculate your estimated earnings at the end of a particular tenure.

As talked about earlier, that a SIP calculator will help us decide the quantity of month-to-month funding in order to accumulate a targeted amount of cash.

One can go to Paisabazaar site or app, go to Direct Plans of Mutual Funds, scroll through numerous funds primarily based on score and fund houses and choose the fund during which you want to take a position.

Q. Is SIP a Mutual Fund? In case you are utilizing the calculator to estimate how much money you have to spend money on a mutual fund scheme in an effort to get a specific amount at the tip of your SIP tenure, then enter the target quantity and calculator shall present the knowledge of required monthly investment.

ETMONEY’s mutual fund SIP calculator offers you two choices as an investor: you possibly can estimate the future value of your funding if you understand the fixed monthly investment value or you possibly can estimate the month-to-month funding amount required to satisfy a predetermined goal. As one can begin investing in SIP with amount as low as 500, the full quantity will generate greater returns over time.

You too can calculate the maturity worth of a SIP funding utilizing the mutual fund calculator. There are numerous SIPs by innumerable Asset Management Companies (AMCs) and one can select amongst them for funding on the basis of AMC ranking, tax saver SIP i.e.

ELSS (Equity Linked Saving Scheme), Net Asset Value (NAV) of the funds,etc. For more help you may visit the official web sites of the businesses to get full data about the pans and its process. A Small amount is light on pocket: Individual SIP installments will be made with an amount as little as Rs.

In SIP Need Calculator, you might want to fill in the main points as the specified quantity or target corpus, number of years in hand and expected charge of return in order to get an estimate of investment you could make month-to-month.

A mutual fund calculator is a device used to estimate the maturity value of mutual fund investment, even earlier than investing the money. SIPs are a more profitable mode of investing funds in comparison with a lump sum quantity according to a number of mutual fund specialists. Rupee-cost averaging: The SIP mode permits an investor to purchase extra items periodically.

Post a Comment for "Ideas, Formulas And Shortcuts For Investment Calculator"